COVID-19 Business Resource Hub

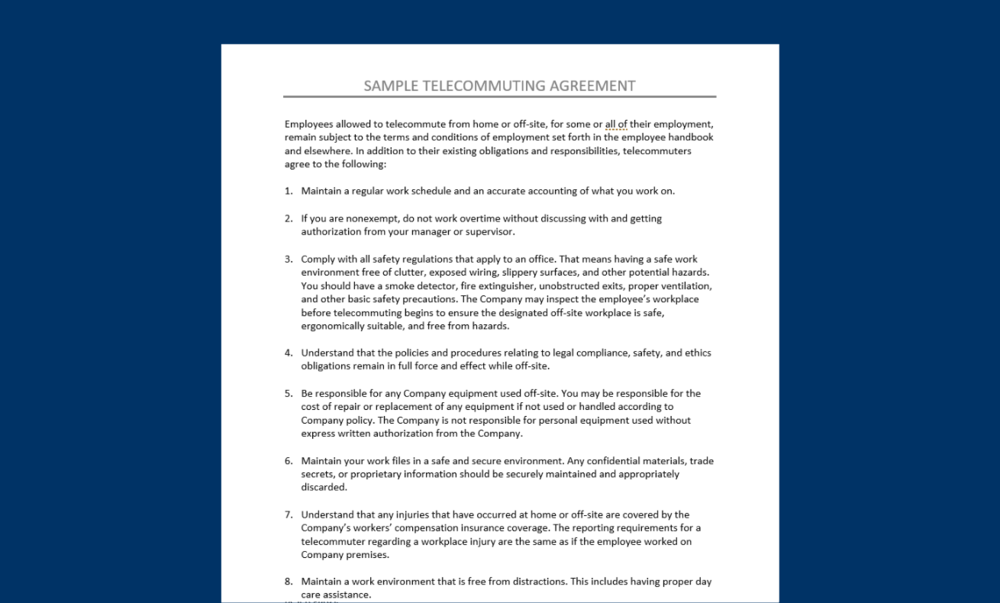

DOWNLOADS

HR On Demand Plus

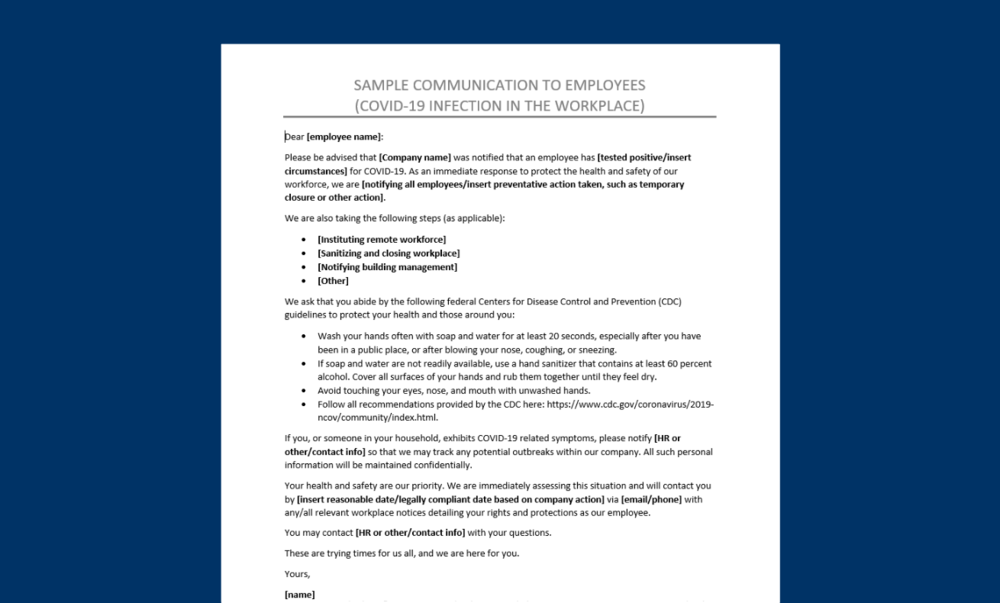

With increasing concerns around the COVID-19 situation

and its impact on the business community, we want to do

our part to ease your HR burden. Learn how HowardSimon can

help with HR On Demand Plus.

On Demand Benefit Sheet

To support our clients during this time we are currently offering the first month free

(cancel anytime)

On Demand Benefit Sheet

To support our clients during this time we are currently offering the first month free

(cancel anytime)

MORE RESOURCES